Hyperliquid exchange and the HYPE token are gaining exponentially more traction with each passing day, and now is the time to learn how this cutting-edge platform works so you can maximize your potential gains with the Hyperliquid (HYPE). As a native token within the Hyperliquid ecosystem, HYPE is designed to empower users, enhance trading performance, and drive community rewards.

In this review, we’ll dig into the features and security Hyperliquid boasts. We’ll help you learn what you need to know to develop the strategies to maximize your gains with HYPE. It just might be the future of decentralized trading.

What is Hyperliquid?

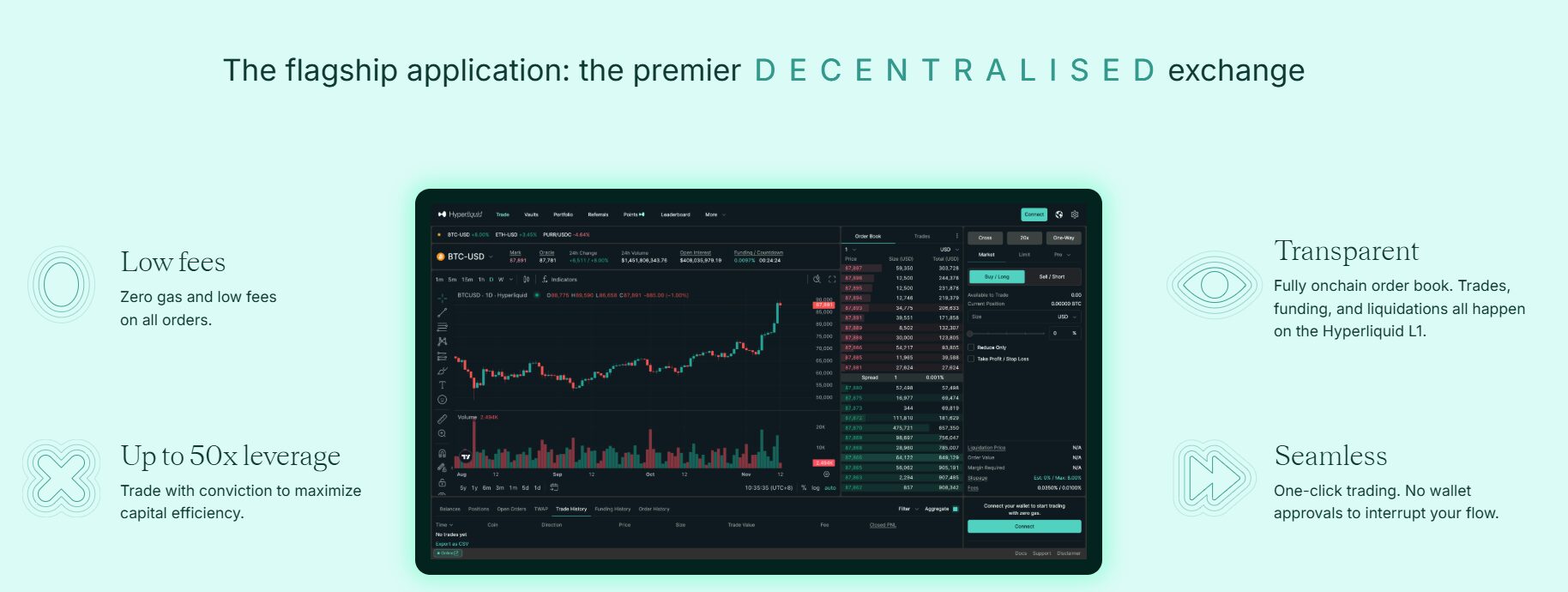

Hyperliquid is a decentralized exchange (DEX) runs on its own Layer-1 blockchain, HyperEVM, which is designed for high performance and scalability. The platform focuses on providing a high-speed, low-fee trading experience for perpetual futures contracts, offering advanced features like scale orders and copy-trading.

Hyperliquid aims to bridge the gap between centralized and specifically decentralized exchanges, creating a hybrid model that leverages the best aspects of both worlds. It functions as a DEX, where transactions occur directly on the blockchain, eliminating the need for traditional intermediary. With a robust infrastructure and a vision to empower users, the exchange is setting new standards for performance and user engagement in the crypto space.

Hyperliquid touts itself as a next-generation platform designed to completely revolutionize how you interact with digital assets. Crafted from the ground up to provide simple, seamless one-click trading, Hyperliquid combines cutting-edge technology with a focus on real-time liquidity and precision. In short, it lets individual traders as well as institutional entities trade with speed and efficiency.

Who Created Hyperliquid?

Hyperliquid is created by Hyperliquid Labs. The platform was founded by Jeff Yan and Iliensinc, two Harvard classmates who lead the Hyperliquid team.

Jeff Yan brings expertise from Hudson River Trading, where he worked on high-frequency trading systems, and later founded Chameleon Labs, a crypto market-making firm, in 2018. Iliensinc complements this with deep knowledge of blockchain technology.

How Does Hyperliquid Work?

Hyperliquid is a decentralized perpetual futures contracts exchange (DEX) that works on its own Layer 1 blockchain that was designed for fast and efficient trading. The platform combines the speed of centralized exchanges with the transparency of decentralized systems. It uses a fully on-chain order book, which means every trade and order is recorded on the blockchain for all to see. Hyperliquid runs on a custom consensus mechanism called HyperBFT; this is a proof-of-stake system that ensures quick and secure transactions.

The exchange supports margin trading. It supports both cross-margin and isolated-margin modes. Cross-margin trading in crypto uses all available funds in a trader’s account as collateral to support multiple positions. Isolated margin trading, on the other hand, allocates a specific amount of funds to each position, so it limits risk to only that amount and protects the rest of the account from liquidation.

You can borrow funds and trade with leverage up to 50x on certain assets. Hyperliquid eliminates gas fees for trades and also uses smart contracts to automate trading processes like order matching and settlements.

Key Features of Hyperliquid

- Custom Layer 1 Blockchain: Hyperliquid runs on its own Layer 1 blockchain with HyperBFT consensus. It processes up to 100,000 orders per second with near-instant finality.

- On-Chain Order Book: Hyperliquid uses a transparent on-chain order book. Every trade and order is recorded on the blockchain for accuracy and fairness.

- Zero Gas Fees: Hyperliquid charges no gas fees for trades. You only pay low maker (0.01%) and taker (0.035%) fees, saving costs.

- High Leverage Trading: Hyperliquid offers up to 50x leverage on perpetual futures. You can trade over 130 assets with amplified potential returns.

- One-Click Trading: Hyperliquid simplifies trading with one-click execution. Connect your wallet once and trade without repeated confirmations.

What Sets Hyperliquid Apart from Other DEXs?

Hyperliquid stands out among decentralized exchanges (DEXs) because of its combination of speed, transparency, and user experience. While most DEXs use automated market makers (AMMs) with slower transactions and greater slippage, Hyperliquid is based on a completely on-chain order book.

The platform has its own Layer 1 blockchain that processes as many as 100,000 orders per second, well above industry players such as dYdX and GMX, who usually operate on Layer 2 platforms such as Arbitrum or Avalanche.

The exchange cuts gas charges, an issue on most other decentralized exchanges, reducing the cost of trading. Hyperliquid provides the same user experience as leading centralized exchanges such as Binance, featuring one-click trades and no constant wallet confirmations. It holds more than 130 assets, far more than most perp DEXs, and provides leverage of up to 50x, comparable to centralized exchanges.

The HyperBFT consensus guarantees sub-second finality on transactions, a feature that outpaces slow chains such as Ethereum. By refusing venture capital and returning profits to users, Hyperliquid values its community above those of many VC-backed DEXs.

What is Hyperliquid Used For?

Hyperliquid is a versatile platform designed to cater to a wide range of crypto trading needs. At its core, it serves as a hub for real-time trading, offering features like one-click order execution and an advanced order book. These tools allow you to trade seamlessly while minimizing slippage and maximizing efficiency.

The HYPE token plays a crucial role in Hyperliquid’s ecosystem. As the platform’s native token, it creates a mechanism for governance, allowing you to participate in decision-making processes that help shape the platform’s future. HYPE tokens are also used to incentivize trading activity and reward early adopters, ensuring a thriving and engaged community.

Beyond trading, Hyperliquid supports user-built applications that leverage its infrastructure. Developers can create decentralized applications, also known as dApps, and other tools that integrate with the Hyperliquid ecosystem, widening the horizons of its functionality even more. Community rewards and staking opportunities provide additional avenues for you to maximize value from the trading platform.

Order Types on Hyperliquid

- Market Orders: Hyperliquid executes market orders instantly at the current market price. You use this when you want to buy or sell immediately without setting a specific price.

- Limit Orders: You set the exact price you’re willing to trade at, giving you control over costs, though execution isn’t guaranteed if the market doesn’t reach your price.

- Stop Market Orders: Hyperliquid triggers stop market orders as market orders when the price hits your selected stop price. Traders use these as stop-loss tools to limit losses or secure profits – for example, selling automatically if a position drops too low.

- Stop Limit Orders: You specify both a stop price to trigger the order and a limit price for execution, offering precision but risking non-execution if the market moves past your limit.

- Scale Orders: Hyperliquid allows scale orders, which break multiple limit orders into a defined price range. You set a range, and the platform spreads your orders across it, helping you enter or exit positions gradually as prices fluctuate.

- TWAP Orders: Hyperliquid splits TWAP (Time-Weighted Average Price) orders into smaller suborders, executed every 30 seconds. You benefit from a maximum slippage of 3%, making this useful for large trades to reduce market impact and average out prices over time.

Hyperliquid Supported Tokens

Hyperliquid exchange supports over 130 tokens for trading, making it one of the most diverse perp DEXs. The exchange lists major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Sui (SUI), alongside stablecoins such as USDC and USDT.

It also offers Wrapped Bitcoin (WBTC) and unique assets like a friend.tech index and LayerZero pre-launch futures, often listing them before other trading platforms.

The HYPE Token and Hyperliquid Airdrop

The beating heart of the Hyperliquid ecosystem is the HYPE token, the native cryptocurrency of the platform. HYPE acts as the foundation for multiple aspects of the ecosystem, including governance, community rewards, and even liquidity incentives. By integrating HYPE into the platform, Hyperliquid ensures that users benefit from both trading opportunities and ecosystem-driven rewards.

As of the time of writing, HYPE token has reached some incredible milestones with both user engagement and trading volume. The Hyperliquid platform has attracted a substantial number of users, contributing to a cumulative trading volume that underscores its growing presence in the crypto market.

At its launch, the HYPE token price was already $3.90, making the airdrop worth more than $1 billion. However, just 12 hours after the launch, the token price surged to $6.16. The value of the token continued to climb in the days following the airdrop. It hit a peak of $14.99 on December 7, 2024. The result of this growth is that the fully diluted valuation of HYPE is now over $12 billion, with a market capitalization of over $4 billion.

HYPE Tokenomics

Hyperliquid’s native token, HYPE, powers its ecosystem with a total supply of 1 billion tokens. The exchange launched HYPE via an airdrop to 94,000 users, distributing 310 million tokens (31% of supply).

The airdrop strategy aimed to help increase the circulating supply, while also creating a substantial genesis event to help draw in additional investors and foster a robust community base. The massive spike in value, post-airdrop, is a solid indicator that HYPE is maintaining strong market confidence.

HYPE offers utility through governance rights, letting holders vote on platform upgrades, and staking rewards, where users lock tokens to earn up to 55% APY while securing the network. You can also use HYPE to pay transaction fees or build decentralized apps (dApps). Hyperliquid also uses a burn mechanism, with 110,000 HYPE tokens burned.

The tokenomics break down as follows:

- 38.888% (388.88 million tokens) is reserved for future emissions and community rewards

- 31% for the genesis distribution

- 23.8% for core contributors (vesting until 2027-2028)

- 6% for the Hyper Foundation budget

- 0.3% for community grants

- 0.012% for HIP-2 allocation

Source: KuCoin

Trading Fees on Hyperliquid

Hyperliquid keeps the fee structure transparent for the benefit of the community at large. In June of 2023, when the mainnet exited its closed alpha, trading fees were introduced at a flat rate of 2.5 bps taker and 0.2 bps maker rebate. Referrers also received 10% of their referees’ taker fees. Unlike many platforms where fees primarily benefit insiders, Hyperliquid directs all fees to the community, specifically to the Hyperliquid Protocol and the HYPE assistance fund. This assistance fund holds a major portion of its total assets as HYPE token, which helps create an incentive where the community directly benefits from the growth and activity of the platform.

Hyperliquid fees are based on your 14-day trading volume. The fees are split into two types: taker fees and maker fees. Taker fees are what you pay when you buy or sell right away, taking liquidity from the market. Maker fees are for adding liquidity, like placing orders that wait to be filled.

For regular users, Hyperliquid trading fees are 0.01% maker and 0.035% taker. If you trade more, like over $2 billion, the taker fee drops to 0.019% and you won’t pay any maker fee.

The liquid native asset on Hyperliquid is HYPE, which is super important for the platform. Most fees collected go to the community. They support things like the Hyperliquidity Provider (HLP) and an assistance fund, which holds a lot of HYPE to stay secure and liquid.

For deposit/withdrawal limits, Hyperliquid doesn’t have strict caps. There’s no deposit/withdrawal fee for USDC withdrawals from the L1, which is awesome because it keeps costs low. Deposits need some gas (ETH on Arbitrum), but trading itself is gas-free.

Is Hyperliquid Safe?

The Hyperliquid Network is secured with a Layer 1 or L1 architecture, which provides solid protection and reliable security for users and their assets. This Hyperliquid L1 security uses a decentralized network of validation nodes to ensure data integrity and ledger transparency. Through the use of its HyperBFT consensus, the potential for any single point of failure is eliminated, and the risk of attacks and breaches is dramatically reduced.

On top of the decentralized structure, Hyperliquid also implements advanced encryption measures to make sure that all sensitive information, like transaction records or specific wallet details, is always kept secure. There are even regular security audits to further harden the platform against potential vulnerabilities, proactively.

However, as a new protocol, Hyperliquid still raises some risks compared to reputable blockchains. The network currently depends on only 16 validators, making it more vulnerable to attacks.

Hyperliquid Vaults

Hyperliquid vaults are a feature that lets users team up and make money by following trading strategies. There are two main types: protocol vaults and user vaults.

Protocol vaults, like the Hyperliquidity Provider (HLP), are run by the platform itself. HLP does stuff like market making and liquidations, earning a chunk of the trading fees. Anyone can deposit USDC into HLP and share its profits or losses, but you have to wait 4 days to withdraw. It’s fully owned by the community, so no one takes an extra cut, making it fair.

Then there are user vaults, managed by vault leaders. Anyone can become a vault leader by putting in at least 100 USDC and keeping 5% of the vault’s total value as their own stake. Vault leaders trade the money in the vault and get 10% of the profits as a reward.

For example, if you deposit 100 USDC into a vault with 900 USDC already, you own 10%. If it grows to 2,000 USDC, you could withdraw 190 USDC—your 200 USDC share minus 10 USDC for the leader’s cut.

Withdrawals take 1 day for user vaults, and there might be some slippage if positions need to close. Vault leaders can share their strategies with followers, kind of like copy trading, which is great for people who don’t want to trade themselves. You can check vault stats like APY and total deposits (TVL) on the Hyperliquid app to pick one that fits you.

How to Bridge to Hyperliquid?

- Set Up an EVM-Compatible Wallet: You need a wallet that works with the Ethereum Virtual Machine (EVM), such as MetaMask, Coinbase Wallet, or Rabby. Install your chosen wallet, create an account if necessary, and ensure it’s ready to connect to Arbitrum.

- Add Funds to Your Wallet on Arbitrum: Hyperliquid only accepts native Arbitrum USDC as collateral, not bridged USDC from Ethereum. Purchase USDC on an exchange like Coinbase, then transfer it to your wallet on the Arbitrum network. You also need a small amount of ETH (about $0.30 worth) in your wallet to cover Arbitrum gas fees.

- Connect Your Wallet to Hyperliquid: Visit Hyperliquid in your browser. Click the “Connect” button in the top right corner. Select your wallet from the list and approve the connection. This links your EVM wallet to the Hyperliquid platform securely.

- Initiate the Deposit via Hyperliquid Bridge: Navigate to the “Deposit” section on the Hyperliquid interface. Choose USDC as your asset, and enter the amount you want to bridge. The trading platform generates a unique deposit address for your transaction.

- Transfer USDC from Arbitrum to Hyperliquid: Open your wallet, select the Arbitrum network, and send your native Arbitrum USDC to the deposit address provided by Hyperliquid. Confirm the transaction, paying the small ETH gas fee. The Hyperliquid Bridge processes this instantly, and your funds appear in your Perpetuals account.

- Move Funds to Your Desired Account: Once deposited, your USDC lands in your Perpetuals account for trading. You can transfer it to your Spot account for other uses or stake it in the HLP Vault to earn yields (up to 24% annually) by selecting “Transfer” and choosing your destination.

Challenges and Risks of Hyperliquid

Challenges

- Fast Transactions: Up to 100,000 ops/sec with <1s finality on its L1 blockchain.

- No Gas Fees: Zero-cost trading, unlike Ethereum-based DEXs.

- On-Chain Order Book: Tighter spreads and less slippage than AMMs.

- Non-Custodial: Users control funds, enhancing security and transparency.

- Community-Focused: Fair $HYPE token airdrops, no VC control.

Risks

- Less Decentralized: Only 16 validators, raising centralization risks.

- Limited Assets: Few spot pairs, withdrawals mostly in USDC.

- Regulatory Risk: No KYC, potential legal issues.

- New Platform: Lacks long-term reliability testing.

Final Thoughts

Hyperliquid’s HYPE token has quickly established itself as a cornerstone of a thriving ecosystem, combining innovation, strong community engagement, and real-time trading capabilities. The security, decentralized operation, and highly impressive early milestones offer you a unique chance to explore the full potential of this token in the constantly evolving crypto space.

FAQs

Where can you buy Hyperliquid?

You can buy HYPE on Hyperliquid DEX and some centralized exchanges including KuCoin, Bitget or Gate.io. However, the token is not listed on many major crypto exchanges like Binance, Coinbase, making it unavailable to purchase or trade on these platforms.

Make sure that your trading platform supports HYPE before starting a purchase. Plus, always double-check token addresses to avoid getting scammed.

What is the market cap of HYPE?

As of March 23th, the current market capitalization for HYPE is $5.3B, which will change based on several factors, including the token value, daily trading volume, and more.

How does the price performance of Hyperliquid compare against other tokens?

Hyperliquid often outperforms its peers with strong growth and stability, despite oracle price fluctuations. Its innovative ecosystem and focus on liquidity make it a reasonably solid choice for investors in the competitive crypto market.

What is the all-time high and all-time low for Hyperliquid (HYPE)?

As of the time of writing, the all-time high for HYPE is $34.96 while its all-time low is $3.81, according to CoinGecko.

What is HYPE Staking?

HYPE staking is a process where you lock up HYPE tokens on Hyperliquid to support the network and earn rewards. In return, you can earn up to a 2.2% annual percentage yield (APY), paid in HYPE. Staking also gives you governance rights to vote on platform changes. You start by depositing HYPE into a staking pool via your wallet on hyperliquid.xyz.

How Do I Deposit on Hyperliquid?

You can deposit on Hyperliquid by bridging USDC from Arbitrum to the platform. Connect an EVM wallet like MetaMask to hyperliquid.xyz, click “Deposit,” and select USDC. Transfer native Arbitrum USDC from your wallet to Hyperliquid’s address – ensure you have ETH for gas fees.

How Do I Withdraw from Hyperliquid?

To withdraw from Hyperliquid, go to Hyperliquid official website, click “Withdraw,” and enter the USDC amount. Sselect “Withdraw from L1” to move funds from Hyperliquid’s blockchain, then “Claim” to send them to your Arbitrum wallet. You’ll pay a $1 fee for Arbitrum gas costs, and you need ETH in your wallet to complete the transaction. The process ensures security but requires both steps to finalize.