Recent investment decisions by major players in Hong Kong and Wisconsin reveal contrasting strategies regarding BlackRock’s Bitcoin ETF, reflecting divergent views on crypto’s role in institutional portfolios.

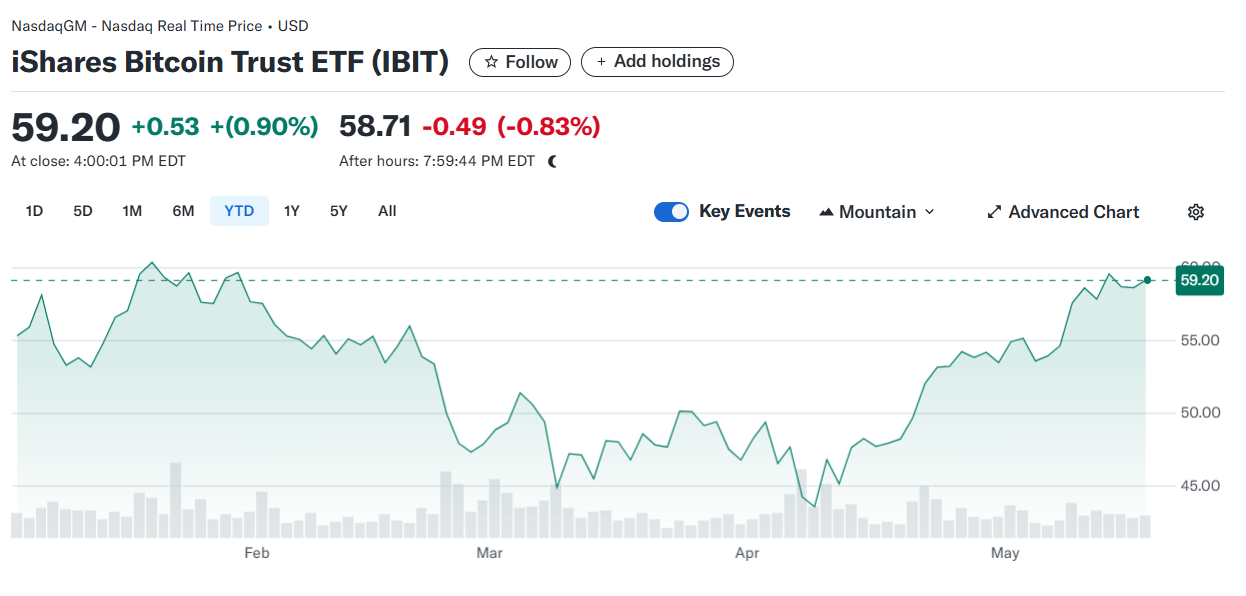

The investment landscape for BlackRock’s iShares Bitcoin Trust ETF (IBIT) has recently showcased stark differences between Hong Kong and Wisconsin, highlighting the varied approaches institutional investors are taking towards Bitcoin. These moves provide insight into the broader trends shaping the adoption of crypto ETFs.

Learn more: How and Where to Buy Bitcoin ETF: A Comprehensive Guide

Hong Kong’s Bold Embrace of BlackRock’s Bitcoin ETF

Hong Kong-based Avenir has significantly escalated its investment in BlackRock’s Bitcoin ETF, amassing 14.7 million shares valued at $688 million by March 31, 2025. This represents a 30% increase in the first quarter alone, as reported by Decrypt.

Avenir’s strategy is part of a larger initiative, having launched a $500 million Crypto Partnership Program in the fall of 2024, aimed at collaborating with global digital asset-focused quantitative trading teams. This aggressive accumulation reflects a strong conviction in Bitcoin’s long-term potential.

The firm’s decision aligns with the surging interest in spot Bitcoin ETFs, which have seen record inflows despite a temporary dip in trading earlier in the spring of 2025. IBIT was trading at $59.20, indicating robust investor interest.

Source: Yahoo Finance

Avenir’s move is indicative of a broader trend in Asian markets, where Bitcoin ETFs are increasingly viewed as a viable avenue for gaining exposure to Bitcoin BTC without the complexities of direct ownership.

Read more: Bitcoin ETFs Reach All-Time High with Over $41 Billion in Inflows

Wisconsin Offloads BlackRock’s Bitcoin ETF

In contrast, the State of Wisconsin Investment Board (SWIB) has opted to reduce its exposure to BlackRock’s Bitcoin ETF, unloading over $300 million worth of shares.

This decision marks a significant downsizing of SWIB’s crypto holdings, which had previously included both BlackRock and Grayscale Bitcoin ETFs worth $163 million as of late 2024.

SWIB’s exit from IBIT suggests a reassessment of its portfolio, likely influenced by market volatility and a strategic shift towards more stable asset classes. SWIB’s role in managing pension funds and other trusts for Wisconsin’s citizens underscores a cautious approach to high-risk investments like Bitcoin.

This move contrasts sharply with Hong Kong’s aggressive stance, illustrating the diverse risk appetites among institutional investors.